Employment

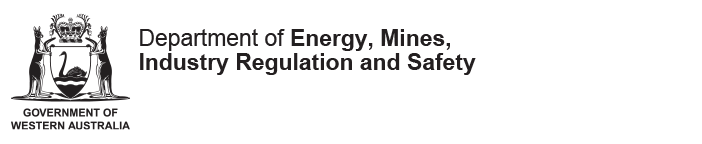

Western Australia’s mining industry employed 126,481 operational employees in full-time equivalent (FTE) terms during 2022-23. This was another record for a calendar or financial year, marking six consecutive financial years of growth, the last five of which have all been new record highs.

The major contributors to mining employment continued to be the iron ore (61,203 FTEs), gold (29,257 FTEs), nickel (9,839 FTEs), tin, tantalum and lithium (8,092 FTEs) and alumina and bauxite (6,995 FTEs) industries.

The number of people on mining operations was up year-on-year for most minerals, with the notable exception of gold (down 1,507 FTEs).

Employment on minerals exploration operations was 4,195 FTEs. While this was a drop from the previous year’s record high, it still represents the second highest employment in minerals exploration in a financial year.

These overall results reflected ongoing strong levels of mining, construction, and exploration activity in the State.

The rate of growth of mining employment in 2022-23 of 6.3 per cent is an improvement on 2021-22, which only saw growth of 4.5 per cent.

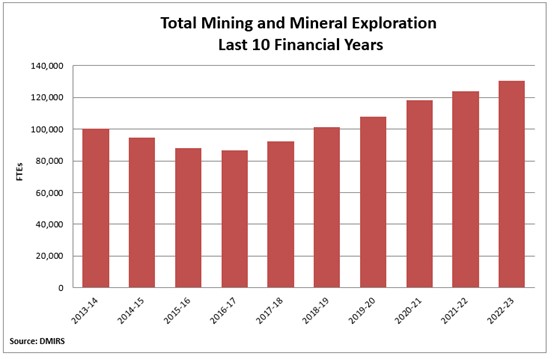

Employment in the State’s petroleum operations dropped slightly in 2022-23 to an average of 12,478 persons, down from 12,960 in 2021-22.

Investment

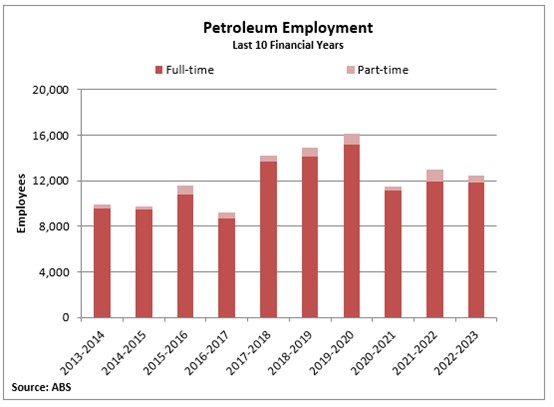

More than $27 billion was invested in Western Australia’s mining and petroleum sector (excluding the smelting or refining of ores and liquified natural gas production) in 2022-23.

This was an increase on last year and represented the highest level of investment for a single calendar or financial year since 2015-16.

It has also increased for 16 consecutive quarters after adjusting for seasonal variability.

However, the level of investment was still less than a third of the highs it reached during the investment boom between 2011 and 2015.

This result was largely driven by new and expanding lithium projects such as Mount Holland and Kemerton, iron ore projects such as Iron Bridge (now in production), Onslow and Western Range, as well as the Scarborough project. It also likely reflected the impact of cost inflation.

Western Australia’s share of national mining and petroleum investment was fairly stable at 58 per cent, around its 10-year average.

The resources sector was again a key contributor (71 per cent) to growth in total new capital expenditure in Western Australia.

However, this also remained well below the greater than 80 per cent share during the investment boom.

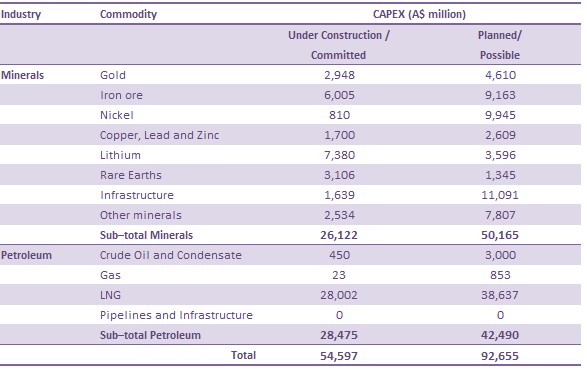

The Department of Mines, Industry Regulation and Safety monitors and collects information on mineral, petroleum, and associated infrastructure projects in the investment pipeline and the estimated capital value of these projects.

Analysis of this information shows that as of September 2023, there was around $55 billion in projects committed and under construction, a decrease of around $5 billion from the March 2023 estimate.

This was due to the completion of two major projects valued at more than $10 billion:

Iron Bridge magnetite, which achieved first production in May and a first shipment in July.

Gorgon Stage Two, which announced the production of first gas in June.

These completions were partially offset by final investment decisions on the KCGM Mill expansion, expansion of the Kemerton lithium hydroxide plant, the Pilgangoora 1000 project, the start of construction on Yangibana rare earths, and upward revisions in expected capital costs for a host of projects including Mardie salt, Mount Holland lithium, and the Kalgoorlie cracking and leaching plant.

The major projects under development and that continued to support investment spending in WA as at September 2023 therefore were:

- Pluto LNG expansion and Scarborough gas.

- Jansz-Io compression (J-IC) project.

- Crux gas.

- Onslow iron ore.

- Western Range iron ore.

- Mt Holland lithium.

- Kemerton lithium hydroxide plant Trains III and IV.

- West Musgrave nickel and copper.

- Eneabba rare earths refinery.

- Mardie salt.

- Mt Weld rare earths mine expansion and Kalgoorlie cracking and leaching plant.

The estimated capital cost of medium to longer-term projects (i.e. feasibility and pre-feasibility stage) was $93 billion, up by $4 billion from the March 2023 estimate.

New major projects announced included BHP’s plans to install 500 megawatts of renewable energy generation and storage capacity by 2030 for its Pilbara iron ore mines, Julimar nickel, and Wodgina Lithium Trains 4 and 5, while the cost estimate for the Kalgoorlie nickel project was increased.

These more than offset the transition of projects that moved into the construction phase (such as the expansion of the KCGM Mill and the Kemerton lithium hydroxide plant), projects with revised development plans and reduced costs (such as Blacksmith iron ore), and projects that were cancelled (such as Admiral Bay zinc).

Exploration

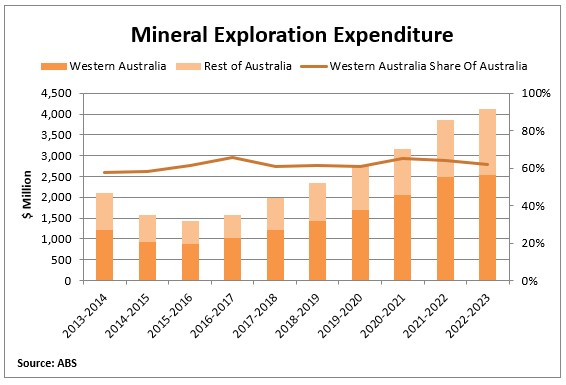

Minerals exploration expenditure in the State was valued at $2.5 billion, a new financial year high but just short of the record $2.55 billion in the 2022 calendar year.

The overall strength in spending targeting minerals reflected:

- Historically high expenditure on gold exploration of $956 million (though it did decline from record levels).

- Iron ore exploration expenditure of $648 million, near to the highest levels in a decade.

- Another single-year record spend on exploration for other minerals, which includes lithium and rare earths, of $419 million (a $123 million increase over the previous high set in 2022).

- A 15-year high in nickel-cobalt expenditure of $287 million and the second highest level for a single calendar or financial year on record.

- Copper exploration expenditure of $188 million, which is high in a historical context.

Spending remained largely focused on brownfields areas or existing deposits. These areas attracted $1.7 billion in expenditure, down marginally from a record $1.8 billion in the 2022 calendar year. In comparison, spending in greenfields locations or on new deposits increased to a record of $814 million.

However, the share of expenditure in greenfields locations, compared to brownfields areas, has not recovered to its pre-COVID-19 levels of around 40 per cent. Its share was around the same level as recent prior years at 32 per cent.

This may well reflect a recent interest in exploration on mature ground for commodities which had not previously been targeted such as lithium and rare earths. Brownfields exploration is also lower cost, which is likely to be a key consideration in an inflationary environment.

WA remained the leading destination for exploration investment in Australia. It accounted for 63 per cent of the national spend, which is around the level it has been for several years.

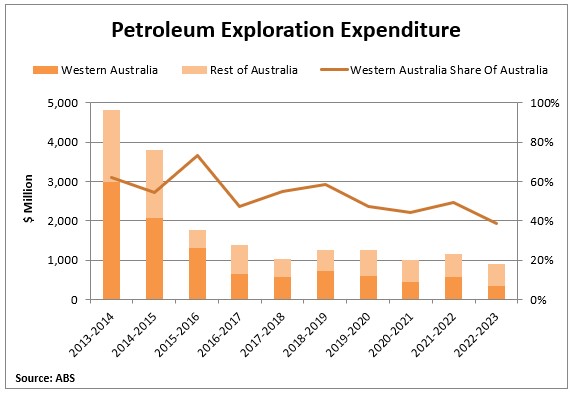

Petroleum exploration expenditure in Western Australia was valued at $352 million in 2022-23. This represented the lowest calendar or financial year spend in the last 25 years.

However, the share of expenditure in greenfields locations, compared to brownfields areas, has not recovered to its pre-COVID-19 levels of around 40 per cent. Its share was around the same level as recent prior years at 32 per cent.

This may well reflect a recent interest in exploration on mature ground for commodities which had not previously been targeted such as lithium and rare earths. Brownfields exploration is also lower cost, which is likely to be a key consideration in an inflationary environment.

WA remained the leading destination for exploration investment in Australia. It accounted for 63 per cent of the national spend, which is around the level it has been for several years.

Petroleum exploration expenditure in Western Australia was valued at $352 million in 2022-23. This represented the lowest calendar or financial year spend in the last 25 years.

This result, combined with a smaller decrease in petroleum exploration spending in the rest of the country (expenditure in Victoria and South Australia increased while expenditure in Queensland and the Northern Territory decreased by less than Western Australia), meant that Western Australia’s share of the national spend fell to 39 per cent. This is the lowest level for a single calendar or financial year on record.

Principal resource projects

Western Australia’s mining industry consisted of 134 predominantly higher value and export-oriented mining projects in 2022-23, up from 129 in 2021-22 and the highest number since DEMIRS began tracking projects on this basis in 2014-15.

The most notable change in the mining industry during 2022-23 was the entry of two new mineral sands projects into the production phase: Strandline Resources’ Coburn project and Australian Garnet’s Lucky Bay garnet project. With these new projects, the total number of mineral sands projects increased to 10 from eight in the previous financial year.

Western Australia also had its first potash project achieve first sales from the Beyondie project in July 2022. The owner and operator of the project, however, Kalium Lakes, subsequently had Receivers and Managers appointed in August 2023.

There were 33 iron ore projects in 2022-23, one less than the 34 projects in 2021-22, a result following the suspension of both the Ridges and Mid West projects in late 2021 and the start-up (and subsequent suspension) of the Paulsens East project in September 2022.

While the number of gold projects was stable at 52, the gold industry had the greatest degree of turnover and activity.

There were six re-started gold projects in 2022-23. Four were short-term campaign mining operations – Aurrenne Group’s Parker Range, Focus Minerals’ Coolgardie, Greenstone Resources’ Burbanks, and Lukah Mining’s The Mount. Two were continuous, longer-term, operations – Northern Star Resources’ Bronzewing and Pantoro’s Norseman.

Six principal gold projects from 2021-22 were either under the threshold (i.e. they did not produce more than 2,500 ounces of gold) or did not operate in 2022-23.

Considerable merger and acquisition activity meant that several gold projects changed hands in 2022-23, including:

- Catalyst Metals acquired Superior Gold, the owner of the Plutonic project;

- Genesis Minerals acquire Dacian Gold, the owner of Mt Morgans;

- Newmont Corporation acquired Newcrest Mining, the owner of Telfer; and

- Gascoyne Resources, the owner of Dalgaranga, changed its name to Spartan Resources.

Several gold projects were suspended or entered care and maintenance during the financial year including the Dalgaranga, Halls Creek, Mt Morgans, Tampia, and Vivien project.

An additional copper-lead-zinc project was added following the start-up of Abra Mining’s Abra project. This brought the total number of copper-lead-zinc principal projects to four, however, the DeGrussa project reached the end of its life during the financial year and the Jaguar project was suspended in September 2023.

The number of nickel projects in Western Australia increased to nine this year, up from eight in 2021-22, due to the addition of BHP Nickel West’s Cliff project as a standalone project (it had previously been considered part of Mt Keith).

There was also an additional silica sand project (bringing the total to three) with Simcoa’s operations achieving more than $5 million in sales (up from less than that threshold in 2021-22) for the financial year.

The State’s mining industry also comprised hundreds of quarries and small mines in 2022-23 that largely produced the basic raw materials required for the local construction or agricultural industry. Such materials include clays, construction materials (aggregate, gravel, rock and sand), dimension stone, gypsum, limestone, limesand and spongolite. There were nine principal producers of these materials in 2022-23.

In 2022-23, there were 15 major mineral processing operations that transformed bauxite into alumina; gold doré into gold bars; nickel ore into nickel concentrate (through toll treatment) and nickel concentrate into nickel matte, nickel powder, nickel briquettes, and nickel sulphate; rutile and synthetic rutile into titanium dioxide pigment; zircon into fused zirconia; silica sand into silicon metal; and spodumene concentrate into lithium hydroxide.

This was one higher than the 14 in 2021-22 with the Kemerton lithium hydroxide plant progressing through commissioning and achieving on-specification and customer qualified product in April 2023.

Western Australia’s petroleum industry consisted of 19 projects that produced oil, gas and condensates from 49 fields in onshore and offshore areas of the State in 2022-23.

Many of these petroleum projects had associated processing plants for LNG exports and domestic gas sales.

This was down from 20 projects and 51 fields in 2021–22.

The Jingemia oil project was removed as it has been shut-in since July 2020.

The number of fields declined in 2022-23 due to the removal of Jingemia, as well as the conclusion of production from the Persephone and Wanaea fields at the North West Shelf. The Redback and Redback South fields at the Beharra Springs project also concluded.

The offshore Lambert Deep field (part of the Greater Western Flank Phase-3 project for the North West Shelf), and the Spartan field (part of Varanus Island) entered production during the financial year.

For an overview of how Western Australia’s commodities performed, please see major commodities review 2022-23.